You are currently browsing the tag archive for the ‘Santander’ tag.

Spain’s largest listed commercial banks reported their year-end results this week, giving some respite from the worries about a new round of restructuring at the country’s teetering savings banks (cajas).

Spain’s listed lenders are generally better capitalised and more profitable than the cajas, thanks in large part to their foreign franchises. Last year, Santander generated 25% of its net profit in booming Brazil, versus only 15% in sickly Spain. BBVA, meanwhile, derived 45% of its earnings from Spain and Portugal, with its Mexican business, home to 37% of group profits, not far behind.

Spain’s third-largest listed bank, Banco Popular, is a largely domestic lender, which is reflected in a higher non-performing loan ratio than Santander or BBVA. Still, Popular remains conservatively capitalised, with a core capital ratio of 9.4%, close to BBVA’s 9.6% and higher than Santander’s 8.8%.

The majority of data and analysis at Financial Services Briefing is available only to subscribers. Each week, a small share of content from the service is made available to non-subscribers.

Concerns about Spain’s sovereign solvency overshadowed a strong set of fourth-quarter earnings from Santander. The resilience of the country’s largest bank in the face of major headwinds is generating praise, but also scepticism.

The sceptics have latched on to rumours about the potential listing of minority stakes in Santander’s US and UK arms. After all, in 2009 the bank was able to offset a spike in loan-loss provisions with capital raised from the listing of its Brazilian unit and sundry other one-off transactions. With worries about Spain’s moribund economy at “fever pitch,” according to a Moody’s report, the listing rumours persist despite denials from Santander’s management.

Even if Spain’s largest bank recorded a 13% rise in net income for the fourth quarter, easily outpacing its nearest rival, BBVA, it seems that opinions about Santander’s prospects are being driven as much by sovereign fiscal concerns as the bank’s own balance sheet.

Read more at Financial Services Briefing: “Santander under scrutiny” (February 11th)

Facing a severe property slump and almost 20% unemployment, Spain is in a deep recession. As a result, the country’s banks must be in trouble. But large, listed lenders are weathering the storm remarkably well, thanks in part to strong franchises in Latin America.

Critics argue that another reason these banks are performing well is because they are skimping on provisions for problem loans. For this reason, as banks reported their latest results—culminating today with Santander, Spain’s largest bank—as much attention was paid to entries deep in balance sheets as headline profit numbers.

A full analysis of reporting season in Spain is now up at the parent site [subscription required].

The majority of data and analysis at Financial Services Briefing is available only to subscribers. Each week, a small share of content from the service is made available to non-subscribers.

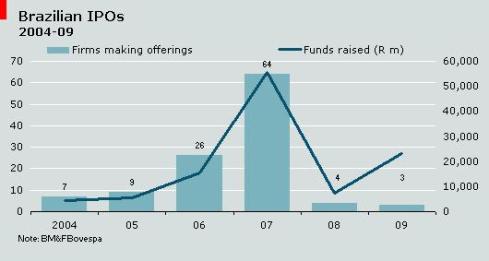

On Wednesday, investors gave a vote of confidence to the IPO market, at least in Brazil. Spanish banking giant Santander raised R14.1bn (US$8.1bn) by selling a stake in its Brazilian unit. It was the biggest listing in the country’s history and the largest in the world since March 2008.

Investors are making an expensive, somewhat risky bet on Santander’s ability to integrate and expand the disparate elements of its Brazilian presence. They are also wagering on the durability of recovery in Latin America’s largest country.

Read more at Financial Services Briefing: “Big bets on Santander offering” (October 7th)