You are currently browsing the tag archive for the ‘microfinance’ tag.

The majority of data and analysis at Financial Services Briefing is available only to subscribers. Each week, a small share of content from the service is made available to non-subscribers.

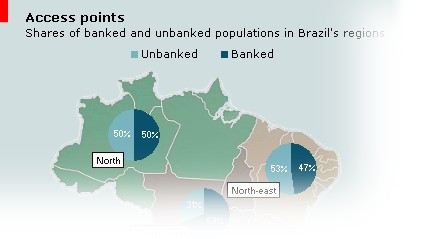

A government-sponsored survey in Brazil has generated debate about the country’s efforts to broaden access to banking services. The nationwide poll, conducted by the Instituto de Pesquisa Econômica Aplicada, a foundation that advises the government on development policy, suggests that Brazilians are otherwise happy with their banks, although there is a gap between the services on offer and those that bank customers would like to receive.

Bank exclusion is an important issue in Brazil. Some 53m Brazilian adults do not have a bank account. Although high, the ranks of the unbanked are much smaller than they were ten years ago, thanks to more workers joining the formal job market. According to the Brazilian Federation of Banks, the number of bank accounts more than doubled over the past decade, reaching 134m at the end of 2009. Reflecting in part the success of policies to promote social inclusion under president Luiz Inácio Lula da Silva, more than 20% of those surveyed by IPEA said that they opened a bank account within the past five years.

Read more at Financial Services Briefing: “Accounts for all” (January 18th)

The majority of data and analysis at Financial Services Briefing is available only to subscribers. Each week, a small share of content from the service is made available to non-subscribers.

The highest-profile microfinance initiatives are in emerging markets. In Europe, it follows that the poorer countries in the continent’s east would be the most amenable to the small-scale loans, insurance and savings that are core to the microfinance business model.

However, there is plenty of scope for microfinance in the richer parts of western Europe. In 2009, more than 84,000 microloans—defined as a loan of less than €37,000—were extended by respondents to a survey published in June, adding up to nearly €830m.

Read more at Financial Services Briefing: “Think small” (October 20th)

As a card-carrying member of the BRIC group of emerging markets, India is expected to serve as a key growth engine of the global economy. For many industries, this remains the case. For the private equity industry, not so much.

For one, Indian private equity deals accounted for only 2% of global transaction value in 2009, according to ARC Financial Services. In addition, dealmaking in India collapsed last year like it did it most other developing, and developed, markets. Deal value, at US$3.4bn, was down nearly 70% on the year before. The average deal size, US$17.5m, was half of what it was in 2008.

For one, Indian private equity deals accounted for only 2% of global transaction value in 2009, according to ARC Financial Services. In addition, dealmaking in India collapsed last year like it did it most other developing, and developed, markets. Deal value, at US$3.4bn, was down nearly 70% on the year before. The average deal size, US$17.5m, was half of what it was in 2008.

Of course, size isn’t everything. With banking penetration low, microfinance institutions in India have plenty of scope for growth (from a deliberately low base). Some 10% of private equity deal volume was in this sector last year, with more to come in 2010, ARC predicts.

The majority of data and analysis at Financial Services Briefing is available only to subscribers. Each week, a small share of content from the service is made available to non-subscribers.

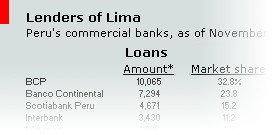

In Peru, unlike in most other parts of the world, gripes among borrowers about miserly lenders are as thin as the Andean air. Local-currency loans to the private sector reached an all-time high recently. The share of non-performing loans is manageable. Deposits are growing strongly.

But for all the progress the country’s banks have made in recent years, few Peruvians use basic financial services. A new bill that requires government bodies and state-owned firms to pay wages via bank accounts, instead of cash handouts, should give the financial sector a further boost. But Peru’s 15 commercial banks may not reap all of the benefits, as they face still competition from a vibrant microfinance industry.

Read more at Financial Services Briefing: “A mountain to climb” (January 5th)