You are currently browsing the tag archive for the ‘Australia’ tag.

The devastating earthquake in Christchurch, New Zealand yesterday was the latest, deadliest natural disaster to strike the region in recent months.

For insurers, losses as a result of the catastrophe are likely to be the largest since Hurricane Ike led to around US$20bn in insured losses in 2008. Early estimates suggest that the Christchurch quake may cost the insurance industry up to US$8bn. This follows an earthquake that struck near Christchurch less than six months ago and cost insurers US$3bn. Australia, meanwhile, was hit with two costly natural disasters earlier this year, as widespread flooding across Queensland caused an estimated US$2bn in insured losses in January, while Cyclone Yasi, which touched down in Queensland in early February, could cost the industry up to US$1.5bn.

Last year, global insured losses from natural disasters were around US$38bn, according to Aon Benfield. The toll from catastrophic events so far this year is already a significant share of 2010’s total and, as the chief executive of an Australian insurance group put it today, “horrible from a human perspective and a financial perspective”.

Although affected by the global downturn, Australia’s economic rebound has made it the envy of the developed world. Recent upward revisions to GDP growth surpassed expectations, and the latest readings indicate a broad-based recovery (in contrast to the US, for example, where a recent jump in growth is down largely to stockbuilding).

Although affected by the global downturn, Australia’s economic rebound has made it the envy of the developed world. Recent upward revisions to GDP growth surpassed expectations, and the latest readings indicate a broad-based recovery (in contrast to the US, for example, where a recent jump in growth is down largely to stockbuilding).

The country’s banks are also participating in the upturn, as detailed in the EIU’s latest forecast for Australia’s financial services industry [subscription required]. Lending growth is expected to rebound relatively strongly from a slowdown last year, and although approval of new loans will not match the pre-crisis pace, the flow of credit in Australia should be freer than almost anywhere else in the developed world in the coming years.

The majority of data and analysis at Financial Services Briefing is available only to subscribers. Each week, a small share of content from the service is made available to non-subscribers.

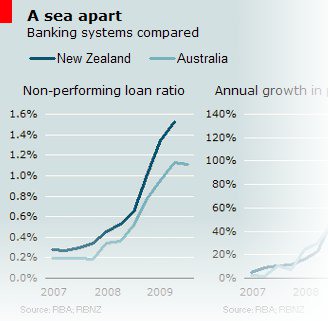

The strength of recovery at Australia’s banks is putting the sluggishness of their New Zealand counterparts in sharp relief. Australia’s largest lender, Commonwealth Bank, recently reported record profits for the six months to December, with earnings rising 50% from the year before.

The lone sour note in the bank’s otherwise triumphant results came from its New Zealand franchise. Its Auckland-based subsidiary, ASB Bank, posted an unexpected loss. Granted, this was largely down to a one-off bill imposed by the state to make up for back taxes related to a settlement with the country’s largest banks (all Australian-owned) over controversial structured finance transactions.

But even excluding this extraordinary expense, ASB’s underlying business lags behind its parent across the Tasman. For various reasons, it is unlikely to be the only New Zealand bank to be a drag on its parent’s profits in the coming quarters.

Read more at Financial Services Briefing: “Left behind” (February 16th)